-

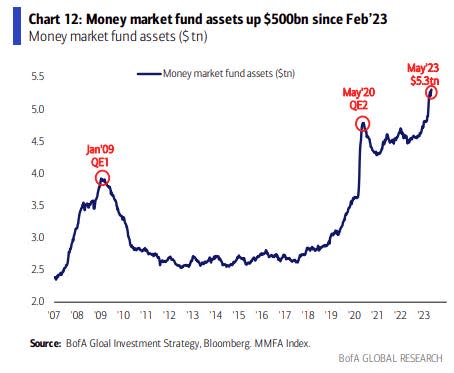

retailers can’t cease piling up money, with belongings in money market funds ballooning to a report $5.three trillion.

-

The surge in money comes amid a combo of extreme fees of curiosity and depressed investor sentiment in the direction of the inventory market.

-

however that large pile of money might presumably be the gasoline needed to drive the following bull market rally.

retailers are hoarding money at report ranges and there is not any signal of the enchancment reversing amid extreme fees of curiosity and depressed investor sentiment in the direction of the inventory market.

money market fund belongings have ballooned to a report $5.three trillion, with inflows surging by $588 billion over the previous ten weeks, in accordance with a current notice from financial institution of America.

That surge in money held by retailers bought here amid a flight-to-safety sparked by the regional banking disaster, whereby three banks with mixed belongings of virtually $550 billion collapsed over a two-month interval.

The current fund stream surge into money market funds eclipsed the $500 billion fund inflows seen after the Lehman Brothers collapse in 2008, and was about half that of the $1.2 trillion that flooded money market funds by way of the onset of the COVID-19 pandemic.

an aspect of the rationale why retailers are stocking up on money is to take benefit of of a extreme hazard-free price of return of simply over 4%. one other excuse is as a end result of retailers are downright bearish on shares.

In AAII’s latest investor sentiment survey, which asks retailers the place they suppose the inventory market will likely be in six months, bearish responses surged to forty five% over the previous week, which is a traditionally extreme studying for the 30+ yr-previous survey. The historic common for bearish responses is 31%.

in the meantime, solely 24% of respondents had been bullish on shares, which means that virtually all retailers are struggling to discover a superb purpose to take a place their money into equities amid the heightened uncertainty tied to the persevering with banking disaster.

And Fundstrat’sTom Lee agrees. that is, if the banking disaster continues to spiral uncontrolled. In a Friday notice, Lee instructed retailers that “that is usually a troublesome time to argue including hazard” given the current collapse of First Republican financial institution and the acute volatility seen in PacWest Bancorp and Western Alliance Bancorp.

“This raises too many tail hazard factors collectively with credit rating tightening, enterprise exact property and broad financial implications,” Lee mentioned. And but, Lee nonetheless sees a balanced hazard/reward setup for the inventory market as a end result of the banking sector reveals indicators of stabilizing and earnings outcomes maintain up greater-than-anticipated.

And if ongoing developments inside the banking sector, financial system, and inventory market flip greater-than-anticipated, then there is an large $5.three trillion pile of money that would act as gasoline to drive the following bull market in shares. that is as a end result of, in accordance with Lee, a lot of the money that is been constructed up over the previous couple of years was withdrawn from the inventory market.

“Retail liquidations of S&P 500 and Nasdaq shares exceeds [retail’s] purchases since 2019,” Lee instructed Insider on Friday, referencing information from Goldman Sachs.

“i really feel shares are flat vs. [a] yr in the past and sentiment far worse and there is far extra money on [the] sidelines. So there’s positively [a] flows story that would unfold,” Lee mentioned. Lee set his 2023 yr-finish worth goal at 4,750, about 15% greater than current ranges.

in the meantime, Carson Group chief market strategist Ryan Detrick instructed Insider that the large pile of money in money market funds is an indication of how frightened retailers are. however that would change pretty quickly if the financial system would not collapse.

“ought to the financial system proceed to shock to the upside, shares might proceed to do effectively and that money might certainly transfer from money to shares,” Detrick instructed Insider.

If that large money pile begins to unwind, retailers have few selections on the place to place it, and the inventory market is most likely going a most acceptable various.

be taught the distinctive article on enterprise Insider

0 Comments