regardless of the investor warning narrative permeating the startup world all by the financial downturn, sure startup-sorts have been a bit extra impervious to market situations. the worldwide current chain was thought-about one of many predominant industrial casualties of the pandemic, so it maybe goes with out saying that firms tackling factors associated to the worldwide current chain would stay an alluring proposition for in any other case hesitant enterprise capitalists.

up to now couple of months alone, we’ve seen Germany-primarily based IntegrityNext ingest $109 million to assist firms audit their current chains for ESG (environmental, social, and governance) compliance; Texas-primarily based Overhaul haul in $seventy three million for a current chain safety platform; San Marcos-primarily based Everstream safe $50 million to deliver predictive insights to current chains; France’s Sesamm snap up $37 million to current corporates ESG insights into their current chain; and India’s Pando pull in $30 million to develop its freight administration platform.

right now, it’s Prewave‘s flip to disclose that the worldwide current chain continues to be thought-about one of many hottest tickets for elevating VC bucks. The Austrian startup revealed that it has raised €18 million ($20 million) in what it’s calling a sequence A+ spherical of funding, following on from its €eleven million ($12.three million) sequence A spherical eight months in the past.

For its latest money injection, Prewave has additionally attracted European VC heavyweight Creandum, which has beforehand backed the likes of Spotify, Klarna, and iZettle.

risk components

Prewave founders Harald Nitschinger and Lisa Smith picture credit: Prewave

based out of Vienna in 2017 by Harald Nitschinger and Lisa Smith, Prewave touts itself as a holistic current chain risk platform that spans “every half of the prospect lifecycle,” by figuring out, analyzing, mitigating, and reporting these risks.

for event, firms comparable to BMW, Lufthansa, and PwC use Prewave to observe every entity of their current chain by way of channels comparable to social media, information stories, and completely different information sources to know not solely what’s occurring inside firms of their current chain, however additionally externalities comparable to earthquakes, floods, political unrest, lawsuits, or worker strikes — something that would influence the worldwide change of merchandise.

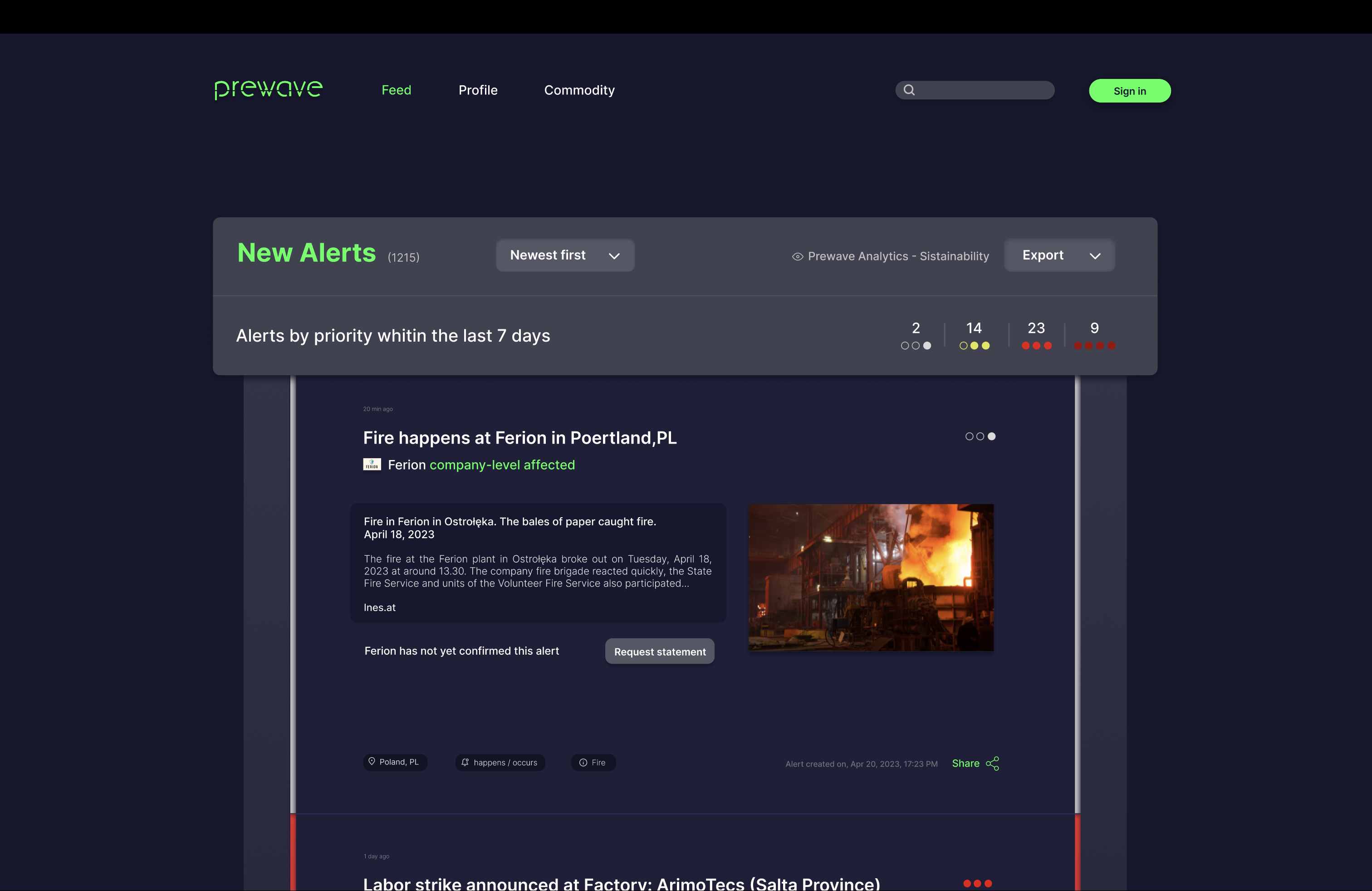

Prewave feed picture credit: Prewave

the agency says it has developed its personal proprietary “crawler” that finds publicly accessible information throughout dozens of languages.

“Having our personal crawler rather than relying purely on exterior current chain information suppliers permits us to continually broaden and enhance our safety,” Smith defined to TechCrunch by piece of email. “We additionally join with a quantity of social media platforms and for particular event sorts we use exterior information sources as for event USGS (united states of america Geological Survey) for earthquake information or GDACS (worldwide disaster Alert and Coordination System) for climate information. the combination of all of these information factors ensures a broad safety of each native and worldwide current chain risk occasions.”

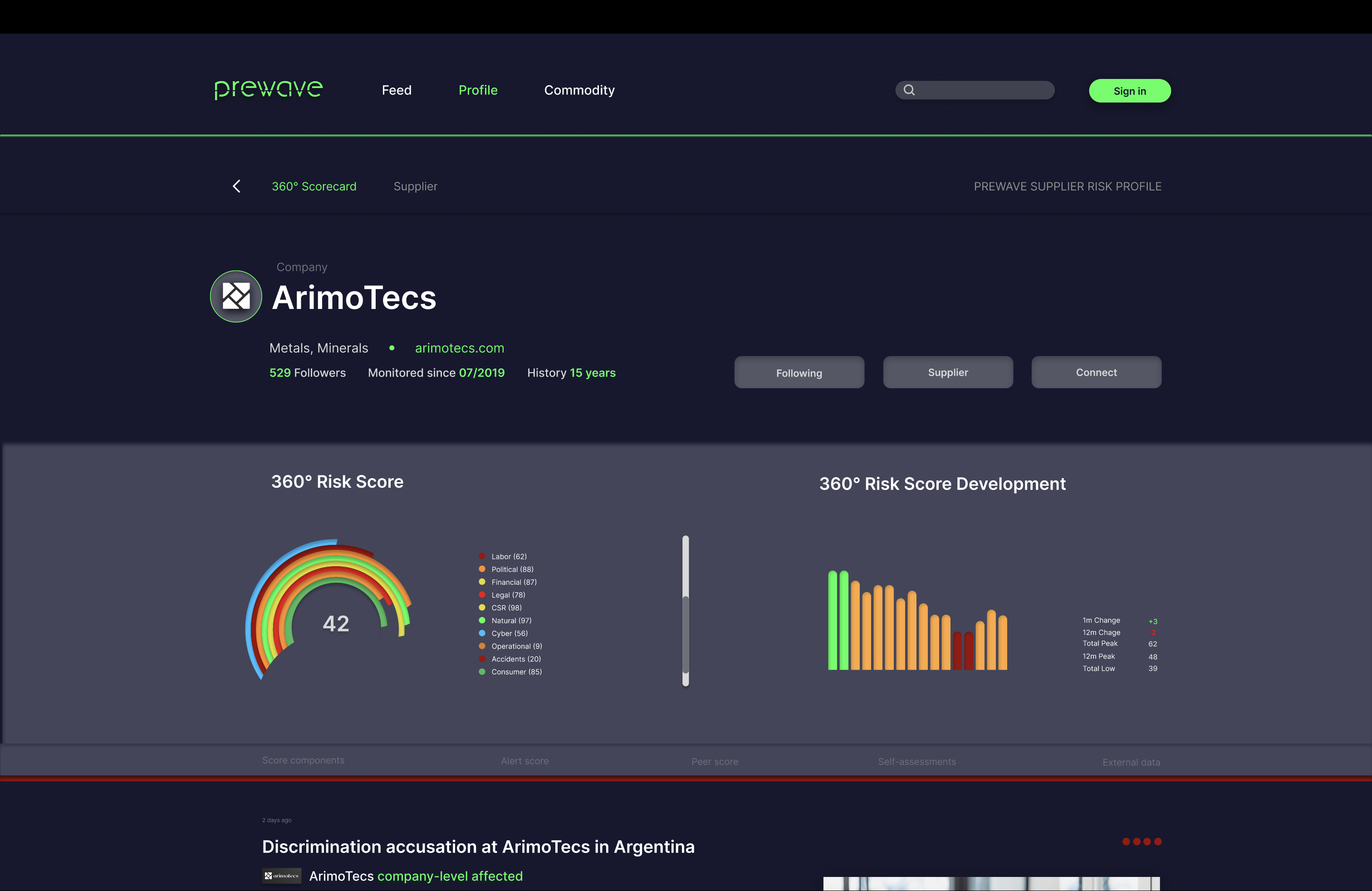

Prewave then crunches all of the information and delivers a dynamic supplier risk rating that adjustments primarily based on all of the mannequin new information it ingests.

Prewave supplier website with 360-diploma scorecard picture credit: Prewave

current (chain) and demand

there are a group of set off demand for current chain insights is skyrocketing, past merely bettering their backside line by averting disruptions. These embody authorized obligations, for event Germany just at the second handed a mannequin new current chain due diligence regulation that makes it the accountability of large firms to hint human rights violations and environmental risks by their current chain. A associated directive is at the second being proposed for the broader European Union (EU) too.

after which there’ll be the straightforward incontrovertible actuality that prospects more and more anticipate the firms they do enterprise with to have at the least some moral and moral ideas, and aren’t purely beholden to shareholder sentiment.

“current chain know-how has withstood the financial headwind in latest instances as a consequence of it has develop to be more and more important for firms to optimize their operations, adapt to exterior risks and minimize again prices inside their current chain,” Nitschinger advised TechCrunch by piece of email. “The pandemic, for event, uncovered vital vulnerabilities in worldwide current chains, making it clear that firms want to take a place into utilized sciences that enhance visibility and sustainability, predict potential disruptions and allow extra agile and responsive strategies. As companies proceed to face financial challenges, the significance of current chain risk administration know-how is merely anticipated to develop.”

With one other $20 million inside the financial institution, Prewave is planning to double down on a latest development that has seen its headcount develop from 20 staff inside the start of final 12 months to greater than a hundred right now, which Nitschinger says “mirrors the substantial income enhance” it has seen over the identical interval.

completely different than lead backer Creandum, Prewave’s latest funding included contributions from Ventech, Kompas, Seed+pace, Segnalita, Speedinvest, Working Capital Fund and Xista Science Ventures.

0 Comments