-

Hindenburg evaluation disclosed a brief place in opposition to Carl Icahn’s enterprise empire this week.

-

Icahn Enterprises plunged 20% the day the brief-vendor launched its bombshell report.

-

From Indian conglomerate Adani to EV agency Nikola, listed right here are Hindenburg’s biggest bets.

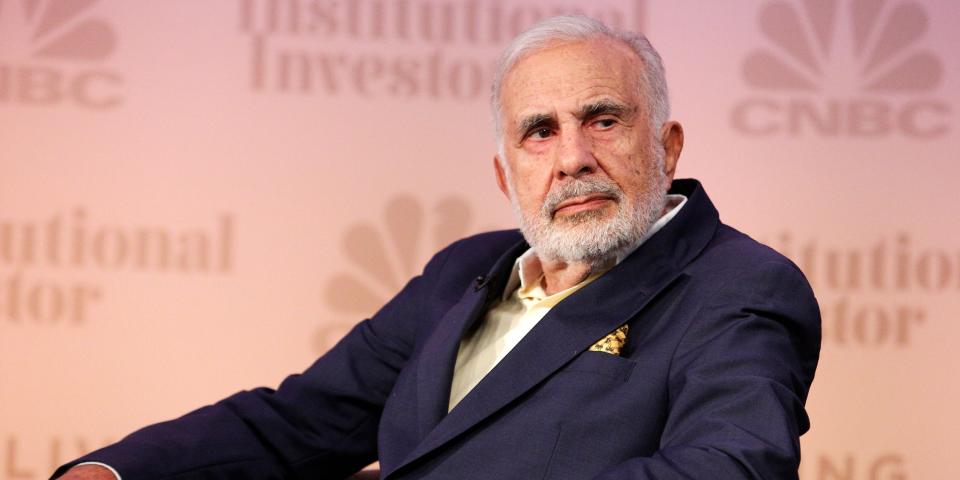

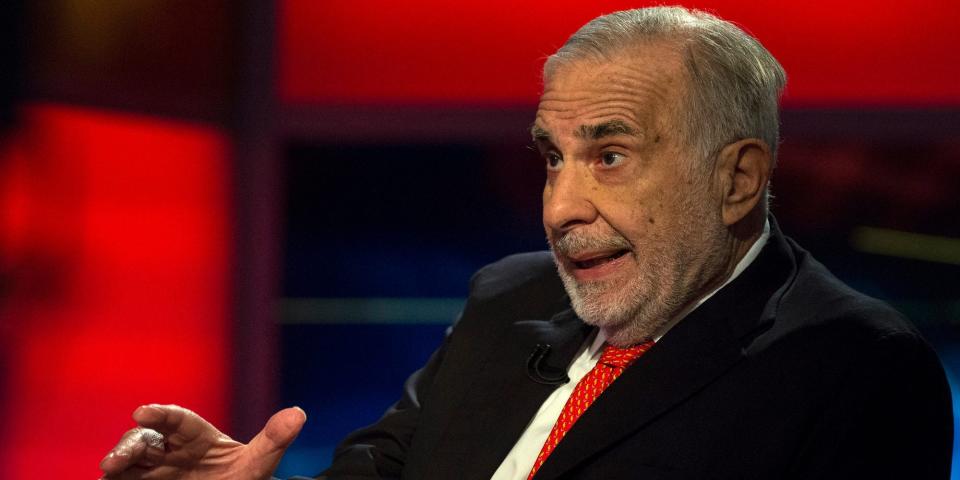

Hindenburg evaluation hit the headlines this week when it unveiled a brief place in opposition to billionaire Carl Icahn.

The activist investor printed a report Tuesday that alleged the Wall road legend’s holding agency Icahn Enterprises had used inflated asset values and been run like a Ponzi scheme.

Hindenburg’s latest huge brief follows the extreme-profile wagers in opposition to Indian conglomerate Adani and Jack Dorsey’s digital funds agency Block it made earlier this 12 months.

listed right here are a pair of of the brief vendor’s biggest bets from the previous three years.

1. Nikola company

In September 2020, Hindenburg launched its first report on Nikola company, saying that the electrical truck producer had exaggerated and misrepresented its merchandise to retailers.

Shares plunged eleven% in a single day and finally look at had cratered to solely $zero.ninety – better than ninety five% beneath the extent they traded on the week Hindenburg first disclosed its brief place.

the agency’s founder Trevor Milton was additionally convicted of fraud in October 2022 after he was found to have lied about Nikola’s expertise to drive up its share worth, as Hindenburg had alleged two years earlier. he is as a outcomes of be sentenced in June 2023.

2. Clover well being

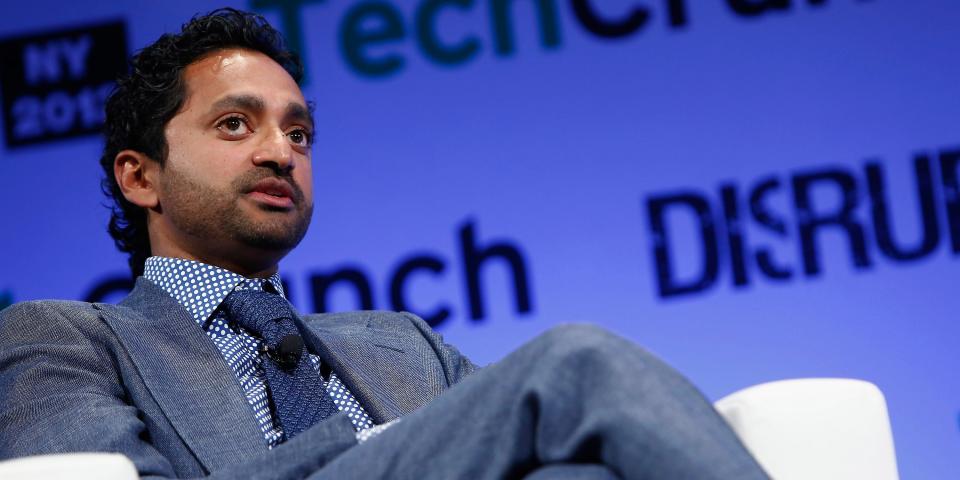

Hindenburg’s subsequent extreme-profile goal was was Medicare benefit insurance coverage supplier Clover well being, which it attacked simply one month after it had listed on the Nasdaq.

The brief-vendor said in a report printed in February 2021 that Clover – as properly as to its “Wall road film star promoter” Chamath Palihapitiya, who took the agency public by way of a SPAC merger – had misled retailers inside the run-as a lot as its itemizing by failing to inform them the division of Justice was investigating it.

Clover shares dropped eight% the day Hindenburg launched its report and like Nikola, have fallen round ninety five% as a outcome of the brief-vendor made its first assault.

three. DraftKings

4 months later, Hindenburg disclosed a brief place in DraftKings.

The activist retailers questioned the sports activities-betting agency’s valuation in contrast with its rivals and in addition alleged that Bulgarian agency SBTech, which it had merged with as an factor of its personal SPAC itemizing, generated vital portions of income from questionable playing practises in overseas markets, collectively with Asia.

DraftKings shares plunged 4% decrease the day of Hindenburg’s report and have crashed one other fifty five% since then, buying and promoting at barely beneath $22 finally look at.

4. Twitter

Elon Musk bid to take Twitter private for $fifty 4.20 a share in April 2022 – and one month later, Hindenburg disclosed a brief place inside the social media huge.

The activist investor predicted that Musk can be succesful to renegotiate that deal to a much less costly worth after Twitter posted poor quarterly outcomes and the world’s second-richest man said he’d promote his current 9.2% stake if his takeover supply wasn’t accepted.

Hindenburg closed its brief place simply eight days later, when shares had plunged to solely over $35. It then introduced a “vital prolonged place” in Twitter in June, betting that Musk would fail in his efforts to again out of the deal although its inventory worth had plunged even further.

Musk later modified his thoughts as quickly as extra in October and purchased Twitter on the initially-agreed worth of $fifty 4.20 a share, at which level Hindenburg provided all its shares.

5. Adani Group

Hindenburg hit the headlines as quickly as extra in January this 12 months when it revealed it was shorting Adani Group.

The brief-vendor said that the Indian conglomerate, managed by billionaire tycoon Gautam Adani, had “engaged in a brazen inventory manipulation and accounting fraud scheme over the course of many years.”

Listed Adani corporations’ share prices plunged after Hindenburg’s report, whereas Adani’s personal wealth has plummeted by $fifty eight billion in 2023 on the again of the inventory market selloff, in response to the Bloomberg Billionaires Index.

The activist investor after which Adani have traded further blows since, with Adani issuing a 413-website response calling Hindenburg the “Madoffs of Manhattan” and Hindenburg responding that “fraud is fraud, even when it is perpetrated by one in all many wealthiest people on this planet.”

6. Block

In March, Hindenburg launched a report on Twitter founder Jack Dorsey’s funds platform Block, which it said had overstated its person numbers and helped to facilitate fraud.

Block shares plunged as a lot as 22% the day the report was launched however have traded roughly flat since then, with the tech agency dismissing the claims and saying it is going to pursue authorized movement by way of the Securities and alternate fee.

7. Icahn Enterprises

Hindenburg took aim at its latest goal this week, slamming Wall road legend Icahn’s holding agency Icahn Enterprises (IEP), which it said used inflated asset valuations and “ponzi-like financial constructions” to maneuver money from new retailers to older ones.

Icahn Enterprises shares plunged 20% the day of the report, wiping round $10 billion off of Icahn’s personal private fortune.

Icahn hit again immediately in opposition to the brief-vendor, saying that he stood by IEP’s public disclosures.

“We think about the self-serving brief vendor report printed by Hindenburg evaluation right this second was supposed solely to generate earnings on Hindenburg’s brief place on the expense of IEP’s prolonged-time period unitholders,” he said in a assertion.

be taught extra: brief sellers have not profited masses from Hindenburg evaluation’s salvo in opposition to Carl Icahn’s funding agency

be taught the distinctive article on enterprise Insider

0 Comments