What’s occurring inside the markets these days? as a consequence of the start of this yr, we’ve seen a power bearish pattern, and now a cycle of extreme volatility. buyers might be forgiven for feeling some confusion, and even some whiplash, in making an try to observe the speedy ups and downs of current weeks.

One important actuality does stand out, nonetheless. Over the previous three months, since mid-June, we’ve see rallies and dips – nonetheless the markets have not severely challenged that mid-June low level. inspecting the state of affairs from evaluation agency Fundstrat, Tom Lee makes some extrapolations from that commentary.

First, Lee factors out that some seventy three% of the S&P-listed shares are in a exact bear market, having fallen elevated than 20% since their peak. traditionally, he notes that a proportion that prime is an indication that the market has bottomed – and goes on to discover that S&P bottoms typically come shortly after a peak inside the pace of inflation.

Which brings us to Lee’s second level: Annualized inflation in June registered 9.1%, and inside the two printed readings since then, it has fallen off by zero.eight factors, to eight.three%.

attending to the underside line, Lee advises buyers to ‘buy the dip,’ saying, “Even for these inside the ‘inflationista’ camp and even the ‘we’re in an prolonged-time period bear’ camp, the very actuality is, if headline CPI has peaked, the June 2022 equity lows should be sturdy.”

a quantity of of Wall avenue’s analysts would appear to agree, not decrease than partially. they’re recommending sure shares as ‘Buys’ proper now – however they’re recommending shares with extreme dividend yields, on the order of eight% or elevated. A yield that prime will supply exact safety in opposition to inflation, offering a cushion for cautious buyers – these inside the ‘inflationista’ group. We’ve used the TipRanks database to pull up some particulars on these current picks; right here they’re, collectively with the analyst commentary.

Rithm Capital Corp. (RITM)

We’re talking dividends right here, so we’ll start with an exact property funding notion (REIT). These corporations have prolonged been recognized for his or her extreme and reliable dividends, and are frequently utilized in defensive portfolio preparations. Rithm Capital is the mannequin new title and branding of an older, established agency, New Residential, which transformed to an internally managed REIT efficient this previous August 2.

Rithm generates returns for its buyers by smart investments inside the true property sector. the agency gives each capital and providers – that is, lending and mortgage providers – for every buyers and prospects. the agency’s portfolio consists of mortgage origination, exact property securities, property and residential mortgage loans, and MSR-associated investments, with the majority of the portfolio, some forty two%, in mortgage servicing.

whole, Rithm has $35 billion in property, and $7 billion in equity investments. the agency has paid out over $4.1 billion in whole dividends because it was first based in 2013, and, as of 2Q22, boasted a e-book worth per widespread share of $12.28.

In that very identical Q2, the final working as New Resi, the agency confirmed two key metrics of curiosity to buyers. First, the earnings out there for distribution bought here to $one hundred forty five.eight million; and second, of that whole, the agency distributed $116.7 million by its widespread share dividend, for a price of 25 cents per share. This was the fourth quarter in a row with the dividend paid at that diploma. The annualized price, of $1, gives a yield of eleven%. That’s elevated than ample, in current situations, to make sure an exact price of return for widespread shareholders.

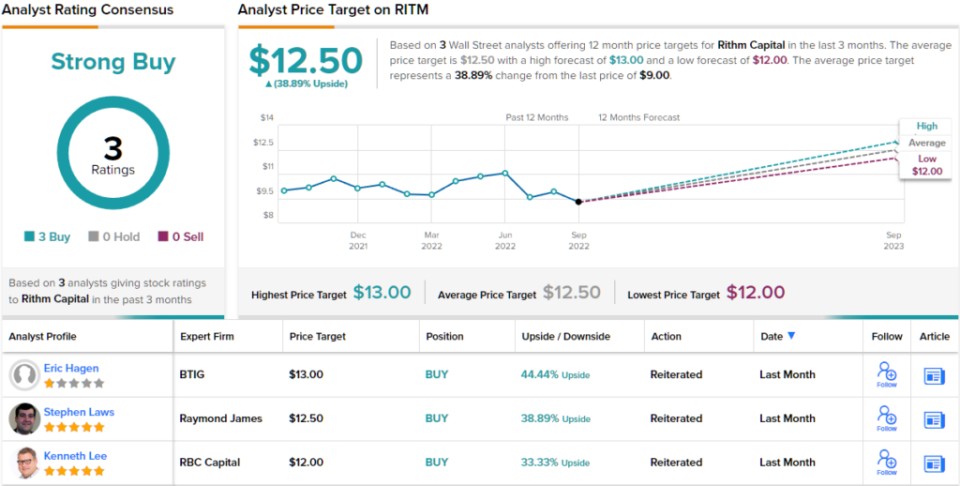

RBC Capital’s Kenneth Lee, a 5-star analyst, lays out a quantity of the motive why he will get behind this title: “We view RITM’s out there money and liquidity place favorably given potential deployment in enticing alternatives. We favor RITM’s ongoing diversification of its enterprise mannequin and expertise to allocate capital throughout strategies, and differentiated means to originate property… we have an Outperform rating on RITM shares given potential revenue to BVPS from rising fees.”

That Outperform (i.e., buy) rating is backed by a value goal of $12, suggesting a one-yr obtain of 33%. based mostly on the current dividend yield and the anticipated value appreciation, the inventory has ~forty 4% potential whole return profile. (to look at Lee’s monitor doc, click on right here)

whereas solely three analysts have been following this inventory, all of them agree that it is one to buy, making the sturdy buy consensus rating unanimous. The shares are promoting for $9 and their $12.50 common value goal suggests an upside of ~39% for the approaching yr. (See RITM inventory forecast on TipRanks)

Omega Healthcare buyers (OHI)

The second agency we’ll take a look at, Omega, combines options of each healthcare suppliers and REITs, an fascinating area of curiosity that Omega has crammed competently. the agency holds a portfolio of expert nursing amenities (SNFs) and senior housing amenities (SHFs), with investments totaling some $9.eight billion. The portfolio leans in the direction of SNFs (seventy six%), with the relaxation in SHFs.

Omega’s portfolio generated $ninety two million in internet income for 2Q22, which was up 5.7% from the $87 million inside the yr in the past quarter. On a per-share basis, this bought here to 38 cents EPS in 2Q22, in opposition to 36 cents a yr prior. the agency had adjusted funds from operations (adjusted FFO) of $185 million inside the quarter, down by 10% yr-over-yr from $207 million. Of significance to buyers, the FFO included fund out there for distribution (FAD) of $172 million. as quickly as extra, this was down from 2Q21 ($197 million), however it certainly was ample to cowl the current dividend funds.

That dividend was declared for widespread inventory at sixty seven cents per share. This dividend annualizes to $2.sixty eight and provides a sturdy yield of eight.4%. The final dividend was paid out in August. collectively with the dividend funds, Omega helps its inventory value by a share repurchase program, and in Q2 the agency spent $a hundred and fifteen million to buy again 4.2 million shares.

Assessing Omega’s Q2 outcomes, Stifel analyst Stephen Manaker believes the quarter was ‘elevated than anticipated.’ The 5-star analyst writes, “Headwinds stay, collectively with COVID’s outcomes on occupancy and extreme prices (particularly labor). however occupancy is growing and ought to enhance extra (assuming no COVID relapse) and labor prices look like growing at a slower price.”

“We proceed to ponder the inventory is attractively priced; it trades at 10.2x our 2023 AFFO, we count on three.7% progress in 2023, and the stability sheet stays a supply of power. We additionally contemplate OHI will protect its dividend as prolonged as a consequence of the restoration continues at an relevant tempo,” the analyst summed up.

Manaker follows up his suggestions with a buy rating and a $36 value goal that reveals his confidence in a 14% upside on the one-yr horizon. (to look at Manaker’s monitor doc, click on right here)

whole, the avenue is chop up down the center on this one; based mostly on 5 Buys and Holds, every, the inventory ekes out a common buy consensus rating. (See OHI inventory forecast on TipRanks)

SFL company (SFL)

For the final inventory, we’ll flip away from REITs and over to ocean transport. SFL company is most seemingly going one in all many world’s primary ocean transport operators, with a fleet of some seventy five vessels – the exact quantity can range barely, as new vessels are acquired or previous vessels are retired or purchased – ranging in measurement from large one hundred sixty,000 ton Suezmax freighters and tankers to fifty seven,000 ton dry bulk carriers. the agency’s ships can carry almost every conceivable good, from bulk cargoes to crude oil to accomplished automobiles. SFL’s owned ships are operated by charters, and the agency has a median structure backlog into 2029.

prolonged-time period mounted charters from ocean carriers are large enterprise, and in 2Q22 launched in $a hundred sixty five million. In internet income, SFL reported $fifty seven.4 million, or forty five cents per share. Of that internet income, $thirteen million bought here from the sale of older vessels.

buyers ought to take observe that SFL’s vessels have an intensive structure backlog, which is in a place to protect them in operation for not decrease than the following 7 years. The structure backlog totals over $three.7 billion.

We’ve talked about fleet turnover, one other important concern for buyers to ponder, as a consequence of it ensures that SFL operates a viable fleet of current vessels. all by Q2, the agency purchased two older VLCCs (very massive crude carriers) and one container ship, whereas buying 4 new Suezmax tankers. the primary of the mannequin new vessels is scheduled for supply in Q3.

In Q2, SFL paid out its seventy 4th consecutive quarterly dividend, a doc of reliability that few corporations can match. The price was set at 23 cents per widespread share, or ninety two cents annualized, and had a sturdy yield of eight.9%. buyers ought to observe that this was the fourth quarter in a row by which the dividend was elevated.

DNB’s 5-star analyst Jorgen Lian is bullish on this delivery agency, seeing no particular draw again. He writes, “We contemplate there’s appreciable prolonged-time period assist for the dividend with out contemplating any potential revenue from the strengthening Offshore markets. If we embrace our estimated earnings from West Hercules and West Linus, the potential for distributable money flows might strategy USD0.5/share, in our view. We see ample upside potential, whereas the contract backlog helps the current valuation.”

Lian areas his view into numbers with a $thirteen.50 value goal and a buy rating. His value goal implies a one-yr obtain of 30%. (to look at Lian’s monitor doc, click on right here)

Some shares slip underneath the radar, deciding on up few analyst opinions regardless of sound efficiency, and that is one. Lian’s is the one current evaluation on doc for this inventory, which is presently priced at $10.38. (See SFL inventory forecast on TipRanks)

to search out good ideas for shares buying and promoting at enticing valuations, go to TipRanks’ biggest shares to buy, a newly launched instrument that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed on this textual content material are solely these of the featured analysts. The content material is meant to be used for informational capabilities solely. it is terribly important to do your private evaluation earlier than making any funding.

0 Comments