The S&P 500 is approaching an essential stage to watch past its 2022 low, as retailers anticipate a spike in jobless claims amid recession fears and soured sentiment inside the U.S. inventory market, in accordance with an RBC Capital Markets observe.

“we count on shares are on the cusp of an essential take a look at,” acknowledged Lori Calvasina, head of U.S. equity method at RBC, in a evaluation observe Sunday. “whereas the June lows now seem unlikely to maintain, if the S&P 500

SPX,

experiences its typical recession drawdown of 27%, the index will fall to three,501.”

In Calvasina’s view, the three,500 stage is essential as a end result of it’s “the function at which a median recession could be priced in,” maybe drawing in some retailers to buy the dip. That’s as a end result of at that stage, primarily based on RBC’s “beneath-consensus” earnings-per-share forecast of $212 for 2023, the index’s forward value-to-earnings ratio would fall beneath common if it hits three,561, in accordance with Calvasina.

“which will open the door for decrease price hunters, although fundamental catalysts for a transfer greater – besides for the midterms – admittedly are onerous to establish,” she acknowledged.

With the Federal Reserve aggressively elevating costs of curiosity in an effort to tame stubbornly extreme inflation, retailers have been centered on what “greater-for-longer costs” might imply for inventory-market valuations, in accordance with RBC.

RBC expects the S&P 500 might finish the 12 months with a value-to-earnings a quantity of of sixteen.35x, primarily based on 2022 expectations for inflation and the federal-funds charge from the Fed’s abstract of financial projections launched after its coverage meeting final week. That calculation additionally components in a three.4% yield on the ten-12 months Treasury observe, which assumes the current charge will come down a bit attributable to recession considerations, in accordance with the observe.

be taught: Fed will try to maintain away from ‘deep, deep ache’ for U.S. economic system, Bostic says

“The mannequin anticipates a P/E of sixteen.35x for a fifty seven% contraction from the pandemic extreme of 37.8x – shut to the contraction that was seen inside the Nineteen Seventies and after the Tech bubble,” Calvasina wrote. “If the S&P 500 have been to commerce at sixteen.35x on our 2022 EPS forecast of $218, the index would fall to three,564.”

And S&P 500 value-to-earnings ratio of round sixteen is “affordable,” primarily based on an evaluation of multiples versus costs and inflation going again to the Nineteen Seventies and current views on these areas, in accordance with RBC.

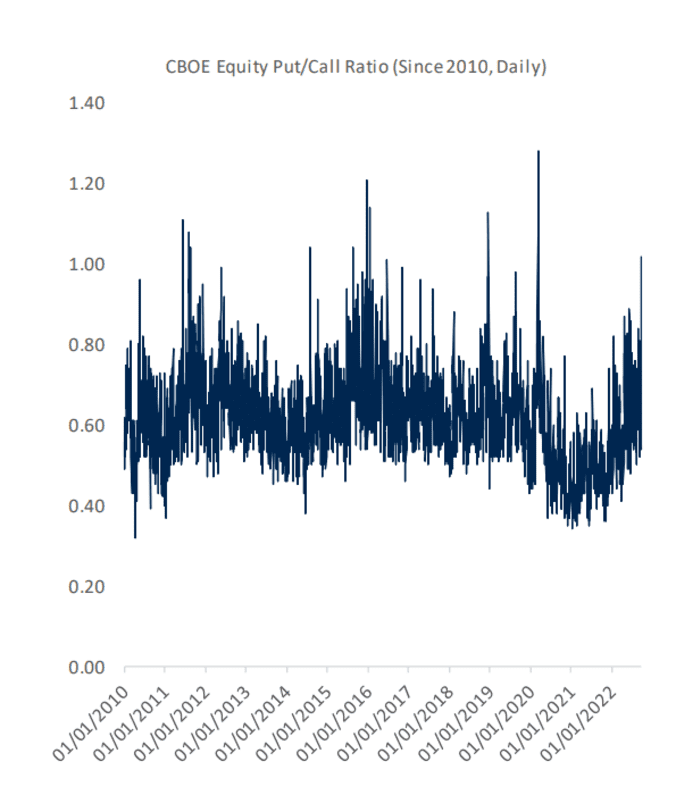

in the meantime, investor sentiment is “on the low finish of its historic fluctuate,” acknowledged Calvasina. She pointed to the equity put–to-name ratio ending final week at its highest stage as a end result of the pandemic whereas approaching December 2018’s extreme.

Put possibility contracts give retailers the proper, however not the responsibility, to promote shares at an agreed up value inside a specified interval. For that set off, additionally they mirror bearishness inside the inventory market. name decisions, which give retailers the proper to buy a safety at a specified value inside a sure timeframe, signal a bullish view.

RBC CAPITAL MARKETS observe DATED SEPT. 25, 2022

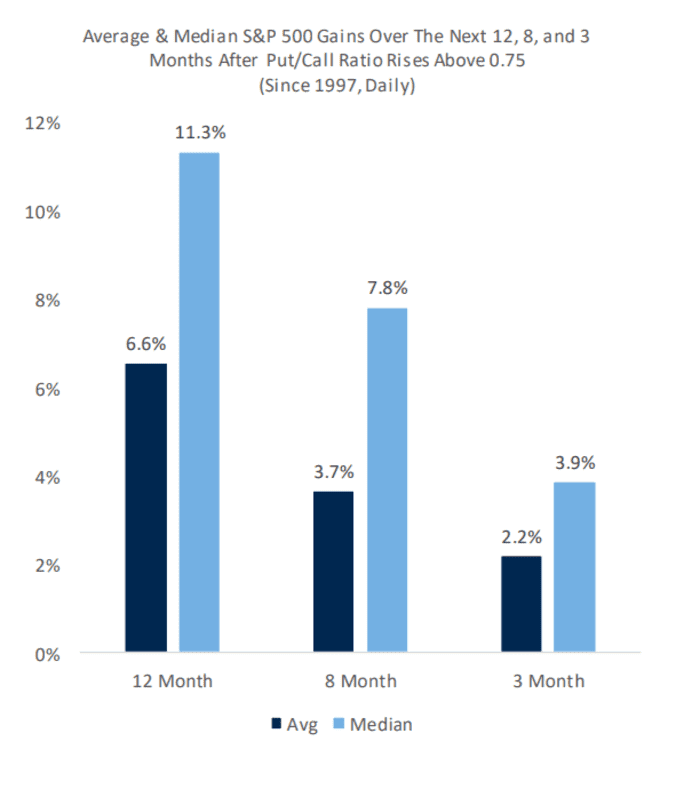

After the put-to-name ratio rises above zero.seventy five, the median buy for the S&P 500 over the following three months is three.9% primarily based on information since 1997, in accordance with the observe. The median buy will enhance to 7.eight% inside the eight months following that stage, and rises to eleven.three% inside the following 12 months after climbing above zero.seventy five, the observe reveals.

RBC CAPITAL MARKETS observe DATED SEPT. 25, 2022

The S&P 500, which has tumbled 22.5% this 12 months by Friday, and was buying and promoting 1.1% decrease Monday afternoon at about three,654, in accordance with FactSet information, finally look at. That’s barely beneath the index’s closing low this 12 months of 3666.seventy seven on June sixteen.

The U.S. inventory market was down Monday afternoon, extending final week’s losses as Treasury yields continued to surge after the hawkish end result of the Fed’s coverage meeting final week. the ten-12 months Treasury yield

TMUBMUSD10Y,

jumped about 20 basis factors to round three.89% in Monday afternoon buying and promoting, FactSet information current, finally look at.

be taught: Morgan Stanley says retailers ought to contemplate this port on the market storm proper now

0 Comments