lastly, retailers have a superb set off for why the U.S. inventory market will undergo above-common volatility and under-common efficiency this month: It’s the Fed.

I say “lastly” as a consequence of market analysts for weeks now have been trying for a set off to wager that 2022 will see a repeat of September’s well-known seasonal tendency to be dangerous for the inventory market. per week in the past, I described September’s historic weak point as an “unsolved thriller.”

be taught: What historic previous says about September and the inventory market

to make constructive that, the thriller nonetheless stays for an extra yr in addition to 2022. however there’s no thriller about what the U.S. Federal Reserve will most likely be doing this month: collectively with persevering with to aggressively elevate expenses of curiosity, the U.S. central financial institution will most likely be significantly accelerating the tempo at which its stability sheet is being decreased.

At a minimal, this double-tightening might even be anticipated to enhance market volatility. Kent Engelke, chief financial strategist at Capitol Securities administration, focused on this consequence in a notice this previous week to consumers: “Writing the plain, the markets and the financial system are coming into into period that nobody has but expert. furthermore as a consequence of of this of lack of expertise, errors will most likely be made. One dealer described at present’s Fed coverage as driving 60 MPH over ice and pulling the emergency brake.”

“ The Fed’s double-tightening will lead to inventory-market losses. ”

It stands to set off that the Fed’s double-tightening will lead to inventory-market losses. comparatively few advisers are specializing in this end result — a minimal of amongst the diverse elevated than one hundred I generally monitor. this means that the double-tightening’s unfavorable influence might not but be completely discounted in inventory prices.

Even fewer advisers are specializing in the central-financial institution tightening now occurring globally. Vincent Deluard, director of world macro at StoneX monetary, wrote this week in a notice to consumers that “the Swiss nationwide financial institution and the PBOC [People’s Bank of China] have started to aggressively shrink their bloated stability sheets. Even the uber-dovish financial institution of Japan has decreased its stability sheet by ¥17 trillion since June and shrinking the ECB’s stability sheet is the subsequent logical step for an institution who has been to this point behind on payment hikes.”

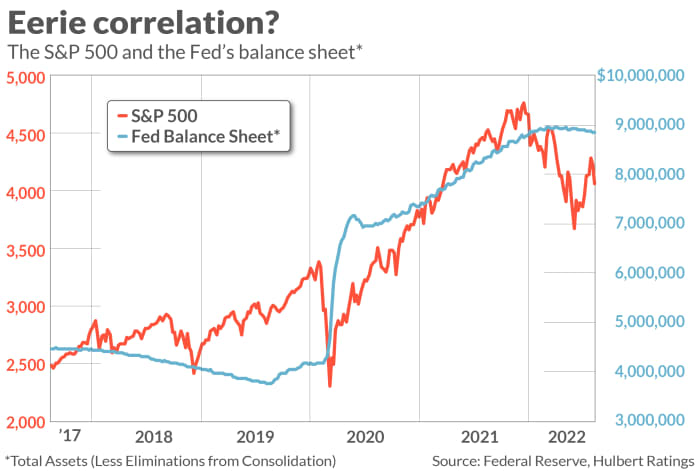

one other excuse to suspect that the Fed’s double-tightening hasn’t but been completely discounted in inventory prices is that in latest instances there’s been an in depth contemporaneous correlation between adjustments inside the Fed’s stability sheet and the S&P 500

SPX,

As you presumably can see from the accompanying chart, the S&P 500 rose markedly inside the wake of the hovering Fed stability sheet in March 2020 — and has struggled in 2022 as a consequence of the pace of enhance of the Fed’s stability sheet started to flatten.

that is worrisome for the set off that Fed’s stability sheet hasn’t truly declined by a lot; it merely has stopped rising at its earlier payment. That’s about to vary, as Deluard notes: “Quantitative tightening will double to $ninety five billion a month in September. The bounce will most likely be all of the elevated as QT has run not on time this summer season: the Fed’s stability sheet dropped by $sixty three billion since QT started on June 1st, about half the promised tempo. furthermore, the latest bounce in mortgage expenses has decreased prepayments so the Fed will likely should actively promote mortgage-backed securities to fulfill its $35 billion month-to-month quota, reasonably than passively letting them roll off its stability sheet.”

It’s a nasty signal that the inventory market has already declined tons of inside the wake of a modest dip inside the Fed’s stability sheet. this means that equity markets are extra hooked on monetary easing than ever. It’s scary to ponder how a lot ache will most likely be important to treatment the markets of its dependancy.

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert rankings tracks funding newsletters that pay a flat payment to be audited. He might even be reached at [email protected]

Don’t miss: uncover methods to shake up your monetary routine on the best New ideas in money pageant on Sept. 21 and Sept. 22 in ny. be a part of Carrie Schwab, president of the Charles Schwab basis.

additionally be taught: ‘put together for an epic finale’: Jeremy Grantham warns ‘tragedy’ looms as ‘superbubble’ might burst

0 Comments