Shares of mattress tub & past Inc. soared Monday, as meme-inventory retailers expressed optimism a day forward of the house items retailer’s strategic replace.

The inventory rocketed 27.4% in afternoon buying and promoting, whereas the S&P 500 index

SPX,

slipped decrease than zero.1%. On Friday, the inventory had climbed 5.9% whereas the S&P 500 tumbled three.4%, after the agency’s announcement that it would maintain a convention name on Aug. 31 to current a “enterprise and strategic replace.”

The latest good points additionally adopted a report inside the Wall avenue Journal that acknowledged the retailer, which has struggled with liquidity factors and slumping gross sales and margins, was nearing ultimate phrases for a mortgage of shut to $4 hundred million.

The inventory’s rally additionally helped current some intraday assist to utterly different meme shares. GameStop Corp. shares

GME,

which reversed an earlier lack of as a lot as 1.eight%, hiked up three.9% on Monday, placing them on observe for the principal buy in 9 intervals. AMC leisure Holdings Inc.’s inventory

AMC,

climbed three.zero%, however pared an earlier decline of as a lot as 2.eight%.

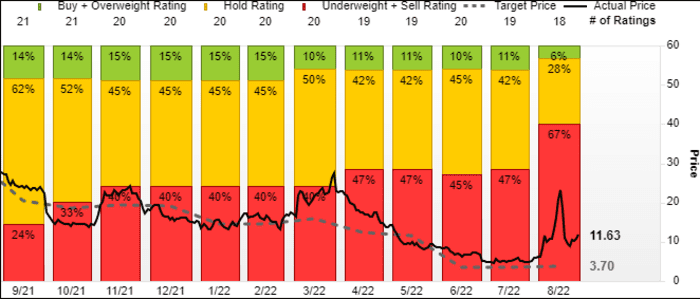

regardless of the mattress tub & past’s sturdy two-day outperformance, most Wall avenue analysts continued to warn retailers to not buy the inventory. Of the 18 analysts surveyed by FactSet, 12 had been bearish and 5 had been impartial, whereas simply one was bullish. the typical analyst value goal for the inventory was $three.70, which implied seventy three% draw again from current ranges.

FactSet

Wedbush analyst Seth Basham reiterated his underperform rating Monday, and stored his inventory value goal at $5.

although the further financing will seemingly bear a a lot greater payment of curiosity and embrace restrictive covenants, Basham acknowledged it ought to “significantly decrease” brief-time period liquidity hazard and “buy the agency extra time to deal with its bloated inventories, value construction and market share losses.”

Basham reminded retailers, nonetheless, that the financing doesn’t change the very confirmed fact that very similar-shops gross sales for the second quarter had been trending down inside the range of unfavorable-20s percentages from a 12 months in the past, and he stays “comfy” collectively with his forecast that working margins will contract by round 12 proportion factors. the agency is projected to report second-quarter leads to late September.

“Even in a smooth demand environment, BBBY’s market share losses are untenable and create hazard into 2023 if BBBY can not enhance its worth proposition to prospects,” Basham wrote in a notice to buyers.

“important operational and steadiness sheet challenges go away us cautious and we think about current hazard/reward nonetheless stays disproportionately skewed to the draw again,” he added.

mattress tub & past’s inventory has plunged forty.9% since Aug. 17, the place it peaked at $23.08 after a meme-inventory resurgence despatched it rocketing 359% in about two weeks.

additionally be taught: mattress tub & past’s inventory snaps longest win streak in 15 years after Baird analyst suggests it’s time to promote.

nonetheless, the inventory has rallied forty seven.7% over the previous three months, whereas shares of AMC have rallied 7.5% and GameStop have shed 7.1%. The S&P 500 has misplaced 2.4% the previous three months.

0 Comments