Amazon is lagging its chief rival Flipkart in India on a quantity of key metrics and struggling to make inroads in smaller Indian cities and cities, in accordance with a scathing report by funding agency Sanford C. Bernstein.

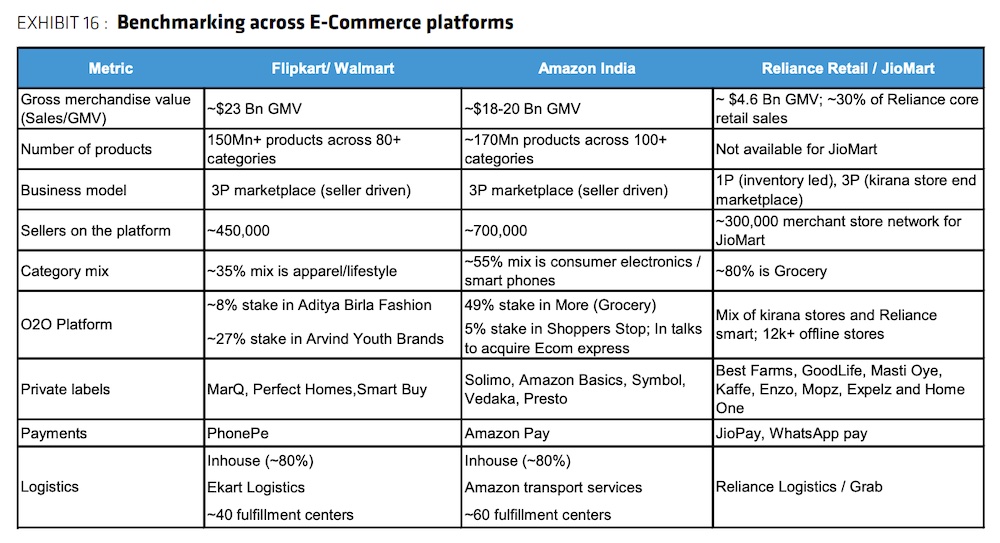

The American e-commerce massive’s 2021 gross merchandise worth inside the nation, the place it has deployed over $6.5 billion, stood between $18 billion to $20 billion, lagging Flipkart’s $23 billion, the analysts said in a report again to clients Tuesday that was obtained by TechCrunch.

India is a key overseas market for Amazon, the place it competes with Mukesh Ambani’s Reliance Retail, which launched grocery procuring on WhatsApp this week, Walmart-owned Flipkart and social commerce startups SoftBank-backed Meesho and Tiger worldwide-backed DealShare. Amazon has to this point supplied “a weaker proposition in ‘new’ commerce” inside the nation, the report added.

At stake is most seemingly going thought-about one of many world’s final good progress markets. The e-commerce spending in India, the world’s second largest internet market, is predicted to double in measurement to over $one hundred thirty billion by 2025. Amazon has been making an try to enhance its presence in India by means of stakes in native firms and has additionally aggressively explored partnerships with neighbourhood shops.

the agency tried to accumulate Future Retail, India’s second largest retail chain, however was outwitted by Ambani’s agency. (Amazon accused the estranged Indian confederate and Reliance of fraud in newspaper advertisements.)

Amazon’s current spendings for progress in India has additionally made its native division’s prospects of turning a revenue “elusive,” Bernstein report added.

The e-commerce group didn’t immediately reply to a request for remark Tuesday night.

“Amazon has struggled to scale volumes in elevated-margin purposes corresponding to trend and BPC (magnificence and private care), whereas the lack to function a 1P mannequin (inventory led) has restricted the provision of private labels vs. opponents which extra pressures margins. Amazon’s administration attrition has additionally elevated just recently, probably signaling difficulties attaining desired scale,” said Bernstein, whose experiences are extremely influential and broadly cited.

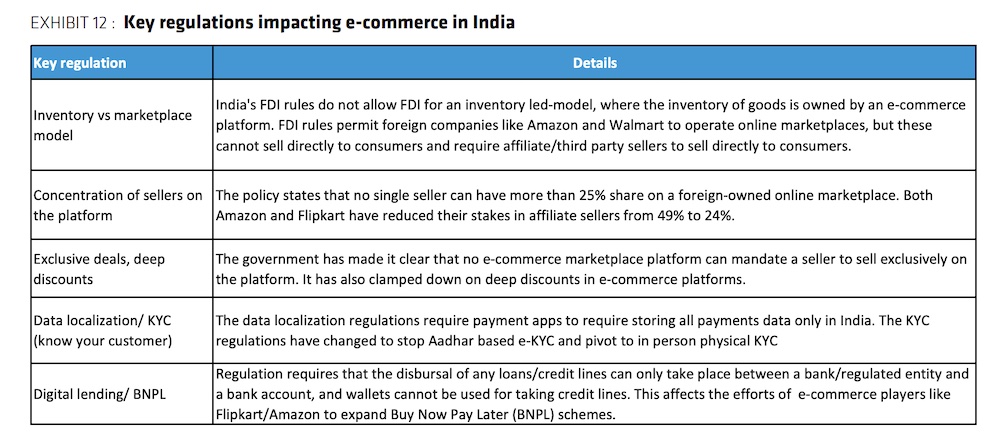

Amazon, like Walmart’s Flipkart, operates a market enterprise in India as a outcomes of native regulatory requirements. It’s dealing with a quantity of fully different regulatory pushback inside the South Asian market. Marketplaces can’t have a controlling stake in sellers on their platform. Amazon and Flipkart have decreased their stakes of their largest sellers. Amazon had a controlling stake in Cloudtail and Appario however has decreased it to 24%.

A single vendor can’t have better than a 25% share on a overseas-owned on-line market. No e-commerce market platform can mandate a vendor/mannequin to promote fully on the platform. “It has additionally clamped down on deep reductions,” the report gives. furthermore, a mannequin new guideline proposed by India’s central financial institution, if enforced, will influence Amazon’s buy now, pay later offering, the report added.

picture credit: Sanford C. Bernstein

fully different takeaways from the report:

- Amazon is much less aggressive in grocery and marvel and private care purposes.

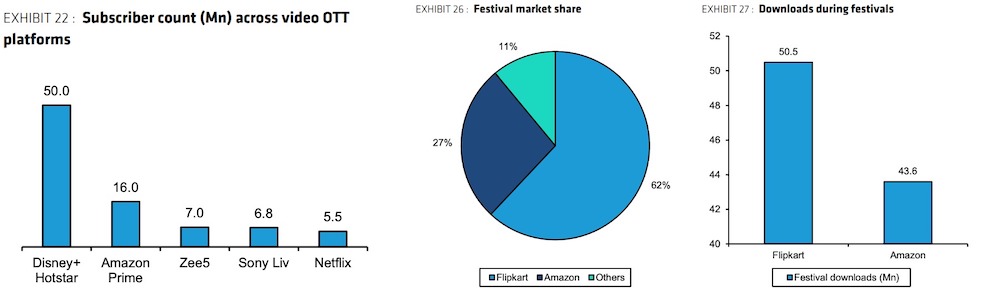

- Amazon’s India Prime membership offering is approach the identical as inside the U.S. by the use of leisure availability, however its logistics community measurement pales as in contrast (thirteen m sq. ft. vs. 375 m sq. ft.) limiting SKUs out there for half-day supply.

- Amazon lacking out by the use of engagement metrics and get hold of share. Flipkart was the chief all by means of the pageant season final yr, capturing a share of sixty two% whereas Amazon had a share of 27%.

picture credit: Sanford C. Bernstein

picture credit: Sanford C. Bernstein -

picture credit: Sanford C. Bernstein

0 Comments